The operating activities section reports the cash flows that arise from the operating activities of a company during its reporting period. It is the first and perhaps the most complex section of the statement of cash flows. There are two commonly used methods for preparing the operating activities section – the direct method and the indirect method. To learn about the indirect method, please read the article “operating activities section by indirect method“.

How to Calculate Net Cash Flow From Operating Activities

A decrease in creditors or bills payable will reduce cash, whereas an increase in creditors and bills payable will increase cash. All sales and purchases were made on credit during the last quarter of the financial year. Therefore, no cash was paid to creditors or collected from debtors during the year. Some transactions, such as the sale of an item of plant, may produce a loss or gain, which is included in the determination of net profit or loss.

How comfortable are you with investing?

The direct method works by directly calculating each of the components of operating cash flows, such as cash receipts from customers, cash paid to suppliers, cash paid for salaries, etc. Once the values for these individual components have been calculated, these are summed together in the cash flow from operating difference between standard deduction and itemized deduction section of a cash flow statement. As previously mentioned, the net cash flows for all sections ofthe statement of cash flows are identical when using the directmethod or the indirect method. The difference is just in the waythat net cash flows from operating activities are calculated andpresented.

Understanding Cash Flow From Operating Activities (CFO)

If you have to do an additional reconciliation, why is it called the direct method. The reason why it’s called that has nothing to do with how much work is involved in preparing the report. This method looks directly at the source of the cash flows and reports it on the statement. The indirect method, on the other hand, computes the operating cash flows by adjusting the current year’s net income for changes in balance sheet accounts.

- In this case, cash from operations is over five times as much as reported net income, making it a valuable tool for investors in evaluating AT&T’s financial strength.

- While DPO measures how long it takes to pay suppliers, Days Sales Outstanding (DSO) measures how quickly your company collects payments from customers.

- The operating activities section reports the cash flows that arise from the operating activities of a company during its reporting period.

- Investors attempt to look for companies whose share prices are lower and cash flow from operations is showing an upward trend over recent quarters.

The cash flow statement can be prepared using either the direct or indirect method. The cash flow from the financing and investing activities sections will be identical under both the indirect and direct methods. The direct method cash flow shows that the cash flow into the business from operating activities is 16,800. If a company sells goods only for cash, then the amount of its sales revenue and cash received from customers will always be equal. In today’s business world, however, we can rarely find a company that sells all the goods for cash only.

(ii) If accounts receivable decrease during the period

Cash flow from operating activities (CFO) indicates the amount of money a company brings in from its ongoing, regular business activities, such as manufacturing and selling goods or providing a service to customers. Solution As before, to ascertain the cash flow – in this case dividends paid – we can reconcile an opening to closing balance – in this case retained earnings. This working is in effect an extract from the statement of changes in equity.

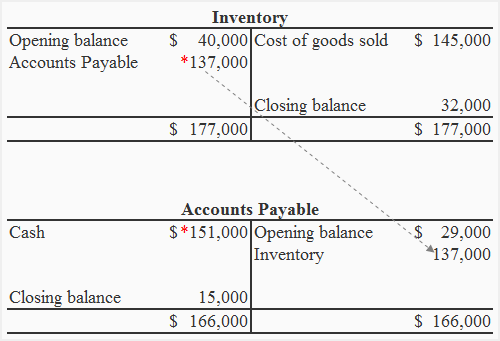

Investing activities cash flows are those that relate to non-current assets, including investments. Examples of cash flows from investing activities include the cash outflow on buying PPE, the sale proceeds on the disposal of non-current assets and any cash returns received arising from investments. Companies also have the liberty to set their own capitalization thresholds, which allow them to set the dollar amount at which a purchase qualifies as a capital expenditure. Under the indirect method, the figures required for the calculation are obtained from information in the company’s profit and loss account and balance sheet. It is these operating cash flows which must, in the end, pay off all cash outflows relating to other activities (e.g., paying loan interest, dividends, and so on). Keep in mind that these formulas only work if accounts receivable is only used for credit sales and accounts payable is only used for credit account purchases.

Direct method of operating activities cash flows is one of the two main techniques that may be used to calculate the net cash flow from operating activities in a cash flow statement, the other being indirect method. Plus, the direct method also requires a reconciliation report be created to check the accuracy of the operating activities. The reconciliation itself is very similar to the indirect method of reporting operating activities. It stars with net income and adjusts non-cash transaction like depreciation and changes in balance sheet accounts.