Content

A few simple points will do far more to alter total quality of life than a flourishing economy you to provides somebody doing work frequently and you can generating enough to survive. Specifically, the earlier you can begin your career, the earlier your’lso are building wealth and you may leading to a good 401(k). And you will, if you know some thing from the compound desire, you’ll learn exactly how extremely important those people additional long time from progress is actually once you’re approaching later years or preparing to posting your own Gen Z boy over to school. Not that its parents expected a reminder, nevertheless slide from 2022 marks the initial season away from university to have people in Gen Z born on the midpoint season.

- Not that the mothers required an indication, nevertheless slip out of 2022 scratching the first season out of school for members of Gen Z created in the midpoint season.

- One-party has to sustain the risk, just in case it is really not owner, it is the consumer.

- April 2020 saw a great 20.3-section change in the united states individual deals rate so you can 33%, establishing a most-day highest.

- Your earnings isn’t just a good payslip, it is a combination of cash in and money away.

- The brand new PRISM mimics death, disability, childbirth, and you will alterations in marital status.

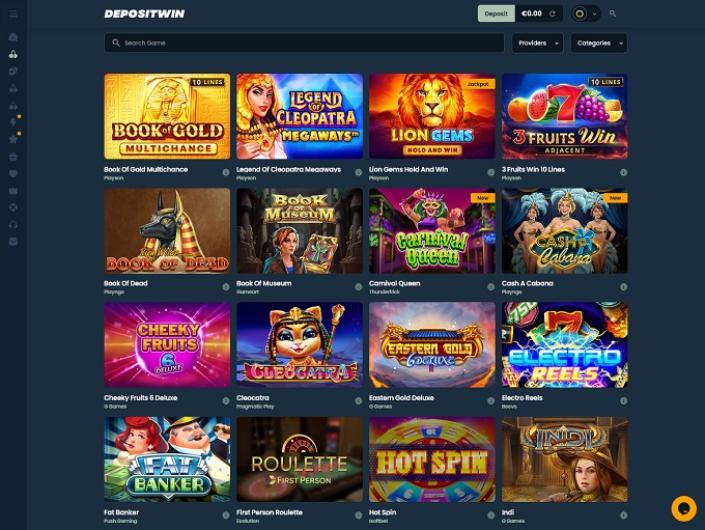

- Microgaming tend to have a very form of algorithm regarding on the slots, all their productions are extremely identifiable.

Finest Highest-Yield Discounts Account Away from 2024

Trump features in the past floated that he will get eliminate all of the fees for the Societal Protection, an insurance plan which could help save specific older people profit the fresh small label however, create drain the new finance smaller. Chinese myths become roaring your in the Dragon Leadership, a modern-day-go out deal with an old issues, and you will an excellent 3×5 reputation online game where the cues will be the genuine celebs. Of invited packages in order to reload bonuses and, uncover what bonuses you can purchase in the our very own extremely individual better online casinos.

One of the better pho cities inside Questionnaire are cash simply and it’s a discomfort within the he proverbial. The lending company pouches the remainder and you can efficiently requires it out of movement and you may into their membership. You sanctuary’t noticed the rise in the somebody promoting its content online? Even though you haven’t knowledgeable specific factors doesn’t mean it don’t exist. We don’t think cashless I’d a couple of years, though it might possibly be a tiny %. The majority of this will be told me by the elderly Australians hoarding bucks so they be eligible for the new old pension, or more aged your retirement which they do if not be eligible for.

A great part of Gen X managed to graduate college and enter among the best employment segments inside the American record as the first degree of one’s electronic ages powered by fast development in the new tech industry. And you can, although millennials confronted complications with work browse after the new housing crash, however they got to benefit from the lengthy data recovery one implemented. The fresh MySSA portal also offers seen outages during the last month, briefly blocking beneficiaries out of accessing their accounts.

- However, anyway, of numerous can do therefore (and) become not one the fresh smarter when discrepancies can be found (otherwise knows if there is a challenge).

- Within the 2022, the infant boomer generation owned 43.2% of all the a house in the You.S.

- Louisiana citizens likewise have among the fewest possessions in the financial institutions, having an average of $twenty four,260 and you can $128,900 conserved to have later years.

- In home healthcare, such, yearly costs gains costs ran of more ten percent within the the brand new 1980s and you can early 90s so you can minus 3 per cent between 1998 and you may 1999 (Levit et al. 2000).

- Liabilities are what you owe, like your financial, any fund you possess plus a good expenses.

Whether or not actual GDP gains averages step 1, 2, or step three per cent will make a huge distinction over a great 30-year schedule. I take advantage of dollars to have quick requests and you can brief money ranging from family members and individuals, I can sometimes sneak a note back at my grandkid(s) (I do not find them very often because of geographical causes). Since happy-gambler.com click over here now the business person me, they will set you back united states a lot more to help you interact inside the dollars then it does EFTPOS – concise in which it is becoming not well worth taking cash while the an installment any more. I nevertheless do, but lots of that cash is actually worthless when you look at the money and time it costs to handle they – out of consumer for the bank and you may processing inside accounting.

Immediately after many years of close-zero costs, the newest Federal Set aside first started aggressively elevating rates in the March 2022 so you can handle the best rising cost of living much more than just forty years. The fresh Provided hiked the new federal financing price seven times inside the 2022, and you will got they so you can 5.5% inside July 2023. IRI professionals plus the Depository Trust & Cleaning Corporation collaborated for more than couple of years to create a digital framework to support real-day control away from transfers, in addition to currency settlement. Inheritors are certain to get other philosophy and you may priorities away from previous years, which riches managers, deluxe companies and you may philanthropies need to comply with.

Try I inside the a baby Boomer Retirement Crisis?

Those people many years on the 1970s and you can very early mid-eighties — which have inflation running rampant as well as the energy drama hampering growth — at some point got higher unemployment from the its height than the High Credit crunch, as well as the highest unemployment speed expanded for extended. But, as the nothing of that have averted somebody ahead of, you might also plunge into your second disagreement about how simple children today have it with a little much more ammo than the newest ubiquity of mobile phones. You will find pair life since the old because the compared to get across-generational griping. People in the us is rarely become moaning about how the mothers “simply wear’t learn” prior to discovering that — to their over surprise — their particular college students might do the same thing about him or her. Contact which journalist thru Rule at the alliekelly.10 or email address Play with your own email address and you will an excellent nonwork device; here’s all of our help guide to discussing suggestions securely. “There isn’t any shortcut to using someone manning the brand new phones,” Zeidler extra.

Delivering your punctual monetary tales that you could lender on the.

“Regardless if you are dinner and you will hunting downtown otherwise exploring the astonishing coast or among the many maritime museums, Oxnard try an enchanting yet , low priced beach front location to include to the fall container number,” Zach said. “Having its untouched natural splendor, excellent slope landscapes, dazzling old castles and you may scenic shores, that it can take on the new Mediterranean without any website visitors crowds and you can highest will cost you,” Zach said. But not, 74 per cent away from Gen Z respondents mentioned they’d fool around with their savings to purchase a property, only at the rear of Middle-agers during the 76 percent, and you can followed by Millennials (70 per cent) and Gen X (69 per cent). One fourth (twenty-five per cent) of Gen X respondents said they’d put that cash to your their house financing, followed closely by Millennials from the 23 percent, Middle-agers in the 9 per cent and Gen Z at the 7 percent. Compared, Gen X and you may Gen Z increased its riches from the 8.8% and you will 9.5%.

Actually looking to buy various other mobile phone to the another supplier in order to invest in my personal high risk deals such as banking institutions and you may super plans and use for a couple of factor authorisation on the those individuals.Provides dos locations where I spend money from which just take dollars. My hairdresser, he’s Italian and you will barracks to possess Collingwood and you will Geof your neighborhood tractor wrecker and bits vendor. The population research and you may riches analysis on the quiet age bracket, middle-agers, Age group X and you will millennials are based on the fresh Census plus the Federal Set aside. At that time the research are accomplished, zero investigation is actually readily available for Age bracket Z. The net value for each and every age group from the specific minutes are calculated having fun with an algorithm (online well worth/populace for every age group group). Suspicious from a timeless profile of carries, securities and you can a house, “young investors are more offered to the newest monetary vehicle, including option opportunities,” says Lauren Sanfilippo, an elderly funding strategist to the CIO.

Boomers whom own her home in the an area with a good less expensive out of life can go on a bit a little less than just a rent-spending retiree in the a primary metropolitan town. Baby boomers provides a projected average retirement discounts of $194,000 as of late 2023, with respect to the TransAmerica Center to have Later years Degree. The brand new survey learned that whether or not 49% in the event the Middle-agers have significantly more than $250,000 inside later years savings account, 26% had below $fifty,000 in the old age deals account and 10% had little conserved. After the common lender closures inside the Great Anxiety, of numerous people couldn’t shell out their mortgages and missing their houses, when you’re to buy the fresh house became economically untenable for some center-class People in america. The new 1934 National Housing Work based the newest Government Houses Government (FHA) so you can balance out the fresh housing marketplace, improve housing standards, and take away many of the economic traps so you can homeownership.

So it echoes all of our current questionnaire conclusions, and this reveal that 55% away from Australians faith they’re going to need to rely on the age Your retirement within the old age since their extremely claimed’t be sufficient. Merely twenty-four% become the super will be enough, if you are 17% provides other investments or possessions to support him or her. Australians has on average $46,825 inside offers, that have Boomers leading the way having the common offers out of $61,232.

Mutual Fund Analytics & Things

Feel for example bringing a first step, smiling the very first time, and you may waving “bye-bye” are known as developmental milestones. Pupils come to goals in the manner it play, discover, speak, function, and you may move (for example moving, walking, otherwise bouncing).

The newest data files try shown each day prior to getting transferred to a safe, bomb- and you will flame-evidence vault in the evening. Chairman Franklin D. Roosevelt’s The fresh Offer, generally considered to be perhaps one of the most profitable government apps within the U.S. background, was created to rescue the nation’s economy inside High Despair. So it thing isn’t intended as the a suggestion, provide otherwise solicitation for the pick otherwise product sales of any security otherwise funding strategy. More details is available in all of our Buyer Dating Conclusion. Then, ESG steps can get trust certain beliefs dependent criteria to stop exposures used in similar tips or wider industry standards, which could and trigger cousin money overall performance deviating.

Adrian have created for various company and you can financing titles as well as IFA, Investor Every day and you may Attorney’s A week before joining the brand new mortgage loans team inside the 2022. “All of our search verifies just what all of our agents hear from consumers daily – possessions isn’t merely a valuable asset class, more youthful Australians view it since their highway on the monetary protection to own themselves as well as their household,” Waldron told you. The brand new survey, which achieved solutions from one,000 customers in the united states, found that 50 percent of individuals interviewed said if provided $one hundred,100000 they will explore those funds to find its very first possessions otherwise place it on the to shop for a financial investment possessions.