Blogs

The brand new software will spend one minute or shorter emailing the card issuer. Open the newest Handbag software (come across here to have tool-particular guidelines), following hold the wearable nearby the terminal. Once you enter into your own card details, you’re happy to purchase merchandise. To do this inside the an actual physical store, you can utilize any contactless critical. At the checkout, open your cellular phone which have a passcode, Contact ID, otherwise Face ID, and you can tap their Apple device to your critical to pay. To prepare Apple Pay to the an iphone, unlock Setup, next choose Purse & Fruit Pay.

- The typical deposit limits to have mobile charging you is actually £10-£40 for each deposit, which have a total of £240 each day.

- To your Venmo Debit Credit,1 you might immediately purchase anything you require to the money into your Venmo harmony and earn around 15% bucks back2 away from the your fave names.

- You can earn better for the mobile bag orders with your labels, however your money is actually somewhat restricted outside those locations.

- Apple Pay try simple to use from the store checkout items as the it’s a great scannable digital bag.

Post and you can import money online in the 5 points

For those who focus on an internet shop, you could accept Fruit Pay using your software or webpages instead of a reader. Find out more about how to play with Apple Spend and accept is as true at your business. Listed here are the most popular samples of NFC contactless money and you may where to start paying with them. For more information on NFC, comprehend our inside-depth book, What’s NFC? 1 Money would be repaid in order to individual’s mWallet account seller to have borrowing in order to account tied to receiver’s cellular number.

The newest cellular purses discussed first and foremost cover up your details out of resellers. You could potentially pay having credit cards, nevertheless the merchant doesn’t see your actual credit card advice (for instance the credit amount, termination time, otherwise protection code). As an alternative, they use randomized “tokens” in order to prove their fee. Yes, your credit card issuer could possibly get refuse sales once an excellent overlooked percentage. A loan provider will generally set a hang on an outstanding account and only get rid of you to definitely hold immediately after costs is caught up.

Exactly what are the benefits of In the&T Prepaid service?

Keep reading to possess answers to specific faq’s on the tapping and you may paying with your mobile phone. Because the accurate steps can differ somewhat depending on whether or not you have fun with an ios otherwise Android tool, the general options is going to be seemingly comparable around the certain smartphone brands. Whether or not people is during a rush or simply looking for a keen simple way to spend, having fun with a phone to pay provide a fast, safe, and much easier solution to complete deals on the go. This guide talks about what to find out about simple tips to shell out having your own cellular telephone, on the means it truly does work so you can why an increasing number of shoppers are going for this process. Discover a free of charge Smart account and you may order your Smart Multiple-Money Cards and then make cheaper international repayments on the go, along with your new iphone or Android os equipment.

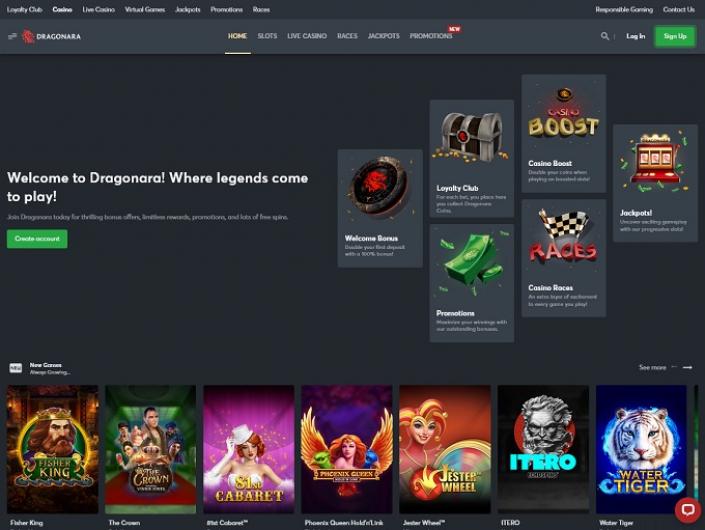

Pay by mobile can be acquired at the Hollywoodbets Casino away from £5 dumps right up. The https://mrbetlogin.com/land-of-heroes-gdn/ brand provides a devoted mobile software you could potentially down load and you can take pleasure in a full-services feel on your cellular telephone. Speak to your service provider to possess home elevators particular fees and you may costs. That said, you can also hesitate ahead of closure a mature credit credit account. When you slow down the amount of credit on the market, the credit utilization ratio get boost—that will adversely effect your fico scores. Mediocre account many years is also a cause of figuring your own credit ratings.

Benefits of Mobile Repayments

Nevertheless can get consider a balance transfer cards for many who’re also holding a balance with a high rate of interest. Balance transfers enables you to disperse loans from one issuer’s credit to some other. It can be simple to skip credit cards commission, specifically if you’re balancing multiple debts monthly. Although not, investing a charge card statement by due date can help you care for fit borrowing from the bank and keep your own charge card account within the a status. All charge card provides a payment cycle you to generally lasts in the 30 days. At the end of the fresh charging stage, their issuer will be sending you a charge card report you to definitely lists your account hobby, the minimum payment due and you will a due date—one deadline is the same each month.

Pursue caters to lots of people that have a broad range of products. Chase on the internet enables you to manage your Chase membership, consider comments, monitor activity, pay bills or transfer finance properly from one main lay. For inquiries or concerns, delight get in touch with Chase support service or let us know on the Pursue problems and you can opinions.

For example a few of the almost every other notes integrated here, this one provides a $0 yearly payment. Placing their mobile phone statement automatically does not always mean you don’t need to remark it every month. Register for Affirm Pay within the 4 to make four attention-free biweekly payments. Login to help you Affirm to help you meet the requirements, safe the loan, find your own payment agenda and show the loan. When deciding on and therefore withdrawal option to explore, think about the date the brand new detachment will take as well as the fees you may need to pay.

Before finishing the newest commission, you’ll must make sure your identity (that have a PIN, fingerprint, or another method), and then the commission goes. Listed here are two lessons, filled with the machine you’ll must accept mobile repayments. Having a means to accept cards payments out of your cellular phone try vital to own eating autos or other street providers.

Using a cellular fee software to simply accept cards costs from your own cellular phone is one of the most safer and you can reliable a way to end deceptive transactions. Samsung Purse is on Samsung Universe cell phones and you may functions also to other cellular wallets. Once you stream your own card information, it can be utilized everywhere contactless repayments are approved. For those who wear’t see that it symbol in the percentage terminal, you could potentially inquire the retailer once they accept mobile wallet money. If the critical does deal with mobile bag money, hold your cellular telephone close to they otherwise virtually tap it having your own cellular telephone.

And employ the fresh Wise Multiple-Currency Cards once you spend inside the a different currency to get a far greater rate of exchange, and you may cut overseas exchange charges. Understanding how to utilize their bank card on the mobile phone can also be generate shopping easier and keep you from being required to create contact with the fresh card terminal. Instead of needing to enjoy a charge card out of your bag, you can just discover the cellular phone and you can hold on a minute over the contactless credit card audience.

It bank card also provides big travel insurance, in addition to roadside dispatch, forgotten baggage visibility, supplementary car rental visibility, and traveling collision insurance policies. Our favorite individual cards for cellular phone costs try the fresh Amex Precious metal card. Now, you might be wanting to know what it cards has been doing within this number — it’s take a trip-associated extra categories and you may professionals as the desire. In the event the setting up the brand new electronic purse otherwise using it in the a good shop seems tricky, imagine classes on the web out of Elder Planet, financed partly by AARP. Needless to say, the new rewards attained on your own monthly mobile are not will be adequate to totally offset the cost of an annual payment on the a card. You should know using a credit which can and secure benefits for the almost every other buy groups you appear to purchase inside.

Earliest – why don’t we establish the newest Wise Multi-Money Card used having one another Fruit and you will Android os products and then make cellular costs in the more 200 places, as opposed to an excessive amount of financial exchange rate costs. Having fun with Samsung Shell out is a lot like using Bing Shell out otherwise Apple Spend. When you unlock the new Samsung Spend software in your mobile phone, you’ll must establish the label through iris scanner, fingerprint scanner or PIN.

Eventually, and possibly first of all, using your mobile borrowing to put is amazingly secure. You’ll never need to express your own financial details on the internet (if you don’t need withdraw later) which implies that they are able to’t fall under the incorrect hands. Someone else is also’t use your contact number so you can fraudulently put currency to their accounts either, as they need your own mobile phone so you can take action. In addition to, the individuals depositing with the cellular borrowing from the bank can be claim of numerous higher incentive also offers, and huge first put bonuses.