For example, Billie’s Watercraft Warehouse (BWW) sells variouswatercraft vehicles. Analysts, therefore, prefer that the revenue recognition policies for one company are also standard for the entire industry. Having a standard revenue recognition guideline helps to ensure that an apples-to-apples irs says acas employer mandate is a forever liability comparison can be made between companies when reviewing line items on the income statement. Revenue recognition principles within a company should remain constant over time as well, so historical financials can be analyzed and reviewed for seasonal trends or inconsistencies.

Completion of performance obligations

This is different from credit extended directly to the customer from the company. In this case, the third-party credit card company accepts the payment responsibility. This reduces the risk of nonpayment, increases opportunities for sales, and expedites payment on accounts receivable.

Gift Card Revenue Recognition

Companies should use these five criteria to guide their revenue recognition practices so their financial statements accurately reflect their performance. Companies also frequently tailor their pricing, sales, and marketing strategies based on the information found in their financial reports. When executives are confident in their organization’s revenue recognition processes and reporting, they can make informed decisions in other business areas.

- Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching.

- Therefore, understanding and applying revenue recognition GAAP is integral to developing sustainable and responsible business strategies.

- Solution – As per the Recognition principle, in the case of goods, revenue is to be recognized when all the risks and rewards related to the underlying asset are transferred.

- In this case, the third-party credit card company accepts the payment responsibility.

Accruals and deferrals

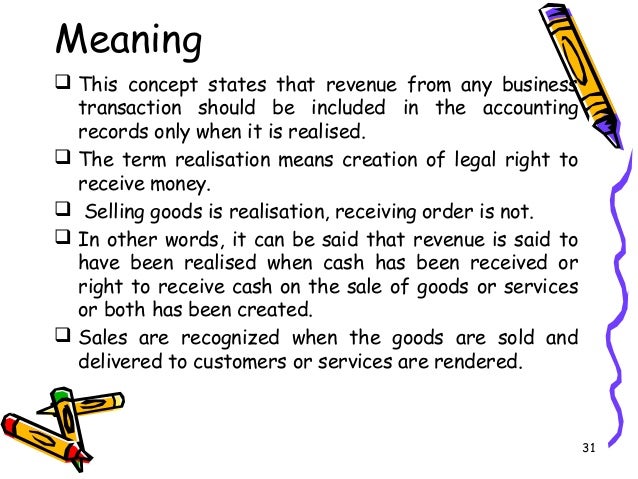

A fundamental point to remember is that revenue is earned only when goods are transferred or when services are rendered. The realization principle of accounting is one of the pillars of modern accounting that provides a clear answer to this question. At the same time, the realization principle also gave birth to the accrual system of accounting. Realization concept requires that revenue shall not be recognized on the basis of cash receipts but should rather be recognized on accruals basis. Contractors PLC entered into a contract in June 2012 for the construction of a bridge for $10 million. The total costs to complete the project are estimated to be $6 million of which $3 million has been incurred up to 31st December 2012.

Thelandscaping company records revenue earnings each month andprovides service as planned. The accrual accounting method aligns with thisprinciple, and it records transactions related to revenue earningsas they occur, not when cash is collected. The revenue recognitionprinciple may be updated periodically to reflect more current rulesfor reporting.

GAAP Supports Revenue Recognition Standards

The customer sets up an in-house credit line with the company, to be paid in full at the end of the six months. The landscaping company records revenue earnings each month (step 4) as they fulfill their performance obligation, which is providing the landscape service as agreed to with the customer. While this “contract” is not in writing, the company has an unwritten contract to transfer new, unbroken equipment to the customer for the agreed upon price—even if the company is getting the cash in the future. All five steps essentially occurred simultaneously in this example, as would be true with many retail transactions. The revenue recognition principle is a crucial accounting concept that guides how revenue should be recognized and recorded in a company’s financial statements.

By adhering to GAAP, companies present a true and fair view of their financial health to stakeholders, including investors, creditors, and regulators. Proper revenue recognition affects the income, balance, and cash flow statements. Second, revenue recognition ensures transparency and accountability in financial reporting.

The delayed payment is a financing issue that is unrelated to the realization of revenues. According to the revenue recognition principle, revenue can be recognized when it is earned and the entity is entitled to receive it. While the realization concept differs from the accrual basis of accounting in its recognition of income and expenses, it is still an important tool for providing reliable financial information. The most common method is to record the revenue when the service is completed for the customer. This method provides an accurate picture of how much revenue has been generated and when it was generated.

For example, a retailer that sells products to customers at a physical store would use the point of sale method to recognize revenue. The revenue is recognized when the customer pays for the product at the time of purchase. These criteria ensure that revenue is recognized when it’s earned, and the company has completed its obligations to the customer.

This method is used when the risks and rewards of ownership transfer to the customer over time. For example, a construction company that builds a house for a customer would use the completed contract method to recognize revenue. Revenue is recognized when the building is completed and transferred to the customer. There are several methods of ASC 606 revenue recognition that a company can use to report its revenue in its financial statements. These methods differ in terms of when revenue is recognized and how it’s reported.

Auditors must also be aware of any changes in the environment that could impact financial reporting and ensure appropriate action is taken to protect investors and stakeholders. Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more.