For example, a software company that provides subscription-based services to a customer for one year could use the percentage of completion method to recognize revenue. 1/12 of the total revenue is recognized each month based on the percentage of the services topic no 458 educator expense deduction 2020 provided to the customer. The third criterion for revenue recognition is the determination of the transaction price. The transaction price is the amount of consideration that a company expects to receive in exchange for providing the goods or services.

Percentage of completion

If the goods or services were transferred on or before the date of invoice, then the sale can be considered complete and the revenue can be recorded. However, if the transfer takes place after the invoice date, then the sale is considered pending and the revenue should not be recognized until the transfer is complete. This principle ensures that businesses only recognize revenue when they have actually earned it, which helps to provide a more accurate picture of their financial situation.

Installment method

- By following these criteria, a company can provide reliable and accurate financial information to its stakeholders.

- The contract should be identifiable, and it should specify the goods or services to be provided, the payment terms, and the time frame for delivery.

- International Financial Reporting Standards (IFRS), which are used in over 140 countries, also incorporate the realization principle but with a slightly different approach.

- They could be products, subscriptions, maintenance services, or anything else the business promises to deliver in exchange for the payment.

- This prevents anyone from falsifying records and paints a more accurate portrait of a company’s financial situation.

As we’ve discussed, it requires companies to recognize revenue based on transferring goods or services to customers at an amount that reflects the consideration to which the company expects to be entitled. Some businesses accept installments, allowing customers to pay for products over a fixed period with equal monthly payments. Under GAAP, revenue recognition usually involves recognizing revenue as payments are received, with each installment payment contributing to the revenue recognition process until the full contract amount is realized.

Challenges in revenue recognition

The revenue realization rate is the percentage of expected or forecasted revenue that is actually realized by a business. It measures how successful a company is in converting booked sales into actual income. SaaS companies that utilize subscription-based models typically recognize subscription revenue over time as services are provided, rather than upfront, per the subscription term. They must also ensure that implementation or setup fees are appropriately allocated over the expected customer relationship period.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Let’s say you’re a B2B manufacturer and had a customer who agreed to purchase $10M worth of goods over the course of a year. Companies must meticulously follow GAAP to provide reliable financial information that facilitates informed decision-making and maintains trust in the financial markets.

In other words, the revenue recognition principle is a crucial concept in accounting that guides the recognition and reporting of revenue in a company’s financial statements. By adhering to this principle, a company can provide accurate and reliable financial information that can be used by stakeholders to make informed decisions. Revenue realization is the process through which a company collects revenue from its sales or services in accordance with accounting standards (e.g., GAAP).

This principle dictates that expenses should be recorded in the same period as the revenues they help generate. For instance, if a company incurs costs to produce goods that are sold in a particular quarter, those costs should be reported in the same quarter as the sales revenue. This alignment helps in presenting a clear and consistent view of profitability over time.

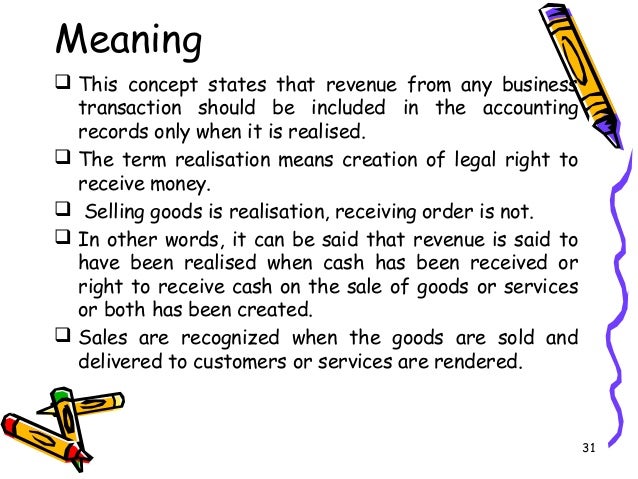

The realization concept is an important part of financial accounting, as it ensures that revenue is recognized in a timely and accurate manner. It also helps to reduce the risk of double counting revenue and ensures that the rightful amount due is collected before goods or services are transferred. The landscaping company will recognize revenueimmediately, given that they provided the customer with thegardening equipment (product), even though the customer has not yetpaid cash for the product. For example, a landscaping company signs a $600 contract with acustomer to provide landscaping services for the next six months(assume the landscaping workload is distributed evenly throughoutthe six months). The customer sets up an in-house credit line withthe company, to be paid in full at the end of the six months.

The company must assess the probability of receiving the consideration it’s entitled to receive under the contract. If it’s not probable that the company will collect the consideration, revenue can’t be recognized. Revenues are realized or realizable when a company exchanges goods or services for cash or other assets. So if a company enters into a transaction to sell inventory to a customer, the revenue is realizable. In this case, the retailer would not earn the revenue until it transfers the ownership of the inventory to the customer.

In addition, ASC 606 shifted revenue recognition away from a very rules-heavy orientation to one that is more judgment-based—giving companies the chance to provide context and reasoning behind their financial picture. Moreover, this evolution led to the development of more comprehensive revenue recognition criteria in alignment with GAAP. For some businesses, it is relatively easy to figure out how and when to recognize their revenue. Retail transactions, for instance, are pretty straightforward—sell the item, immediately give it to the customer, and record the revenue. In this second example, according to the realization principle of accounting, sales are considered when the goods are transferred from Mr. A to Mr. B.

The revenue shall be recognized when such goods are delivered or the services are rendered to customers. Last but not least, we recognize revenue when the performance obligation is satisfied either over time or at a point in time. The realization principle of accounting revolves around determining the point in time when revenues are earned. Auditors pay close attention to the realization principle when deciding whether the revenues booked by a client are valid. They also look at all aspects of the requirements for revenue recognition, as outlined within the applicable accounting framework.